Menu

Search

Enquire

User Menu

Menu

Search

Enquire

User Menu

Menu

Search

Enquire

User Menu

Menu

Search

Enquire

User Menu

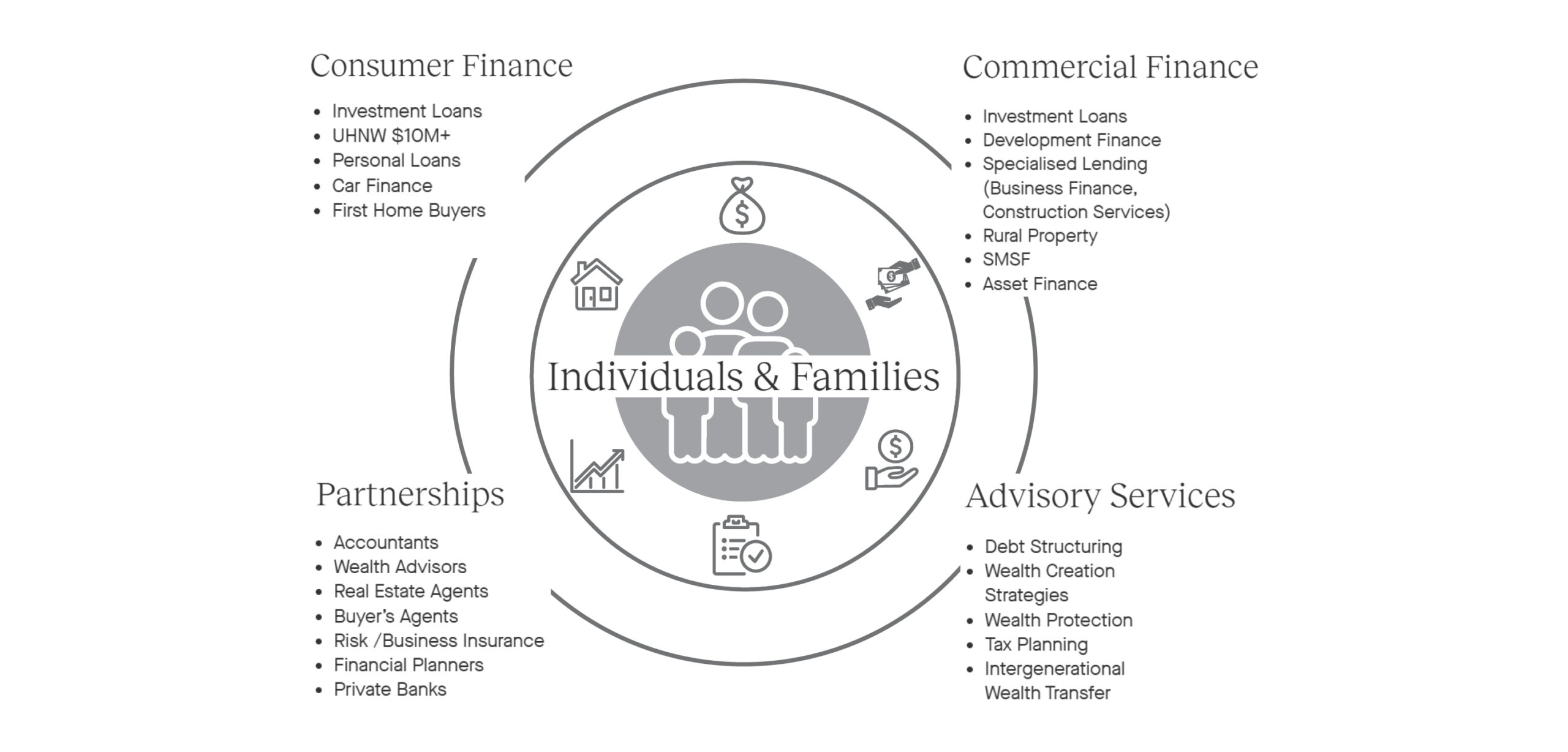

HTL Private Office specialises in providing bespoke advice in structured finance for the acquisition of residential and commercial real estate, new business ventures, and investments across all asset classes.

In today’s complex lending and investment markets landscape, our expertise supports in empowering clients and their families to achieve their growth ambitions while maintaining desired returns within diversified asset classes.

Our services include securing capital, designing financing structures for new acquisitions, restructuring or refinancing existing agreements, property development and asset protection solutions.

UHNW Solutions ($10M+) – Exclusive financing and investment opportunities for Ultra High Net Worth individuals.

SMSF Finance – Leverage your SMSF for property investment with expert guidance.

Investment Loans – Competitive loans for residential and commercial property investments.

Rural Property Finance – Tailored financing for rural property investments.

Development Finance – Capital solutions for property development projects.

Specialised Lending – Custom financing for business, construction, and niche projects.

Car & Commercial Finance – Financing options for luxury and commercial vehicles.

Relationship-Driven – Personalised service focused on long-term relationships.

Customised Solutions – Tailored to your specific financial goals.

Expertise Across Assets – Knowledgeable in real estate, business, and investment finance.

Fast & Efficient – Quick access to the best financial products and structures.

Let HTL Private Office guide your financial journey with tailored consumer and commercial finance brokerage services.

Whether you’re a seasoned investor, or UHNW individual, we’re here to help you grow and protect your wealth with confidence.

HTL Private Office Pty Limited ACN 680120610 is authorised under LMG Broker Services Pty Ltd ACN 632 405 504 Australian Credit Licence 517192

THE INFORMATION PROVIDED ON THIS SITE IS ON THE UNDERSTANDING THAT IT IS FOR ILLUSTRATIVE AND DISCUSSION PURPOSES ONLY. WHILST ALL CARE AND ATTENTION IS TAKEN IN ITS PREPARATION ANY PARTY SEEKING TO RELY ON ITS CONTENT OR OTHERWISE SHOULD MAKE THEIR OWN ENQUIRIES AND RESEARCH TO ENSURE ITS RELEVANCE TO YOUR SPECIFIC PERSONAL AND BUSINESS REQUIREMENTS AND CIRCUMSTANCES. TERMS, CONDITIONS, FEES AND CHARGES MAY APPLY. NORMAL LENDING CRITERIA APPLY. RATES SUBJECT TO CHANGE. APPROVED APPLICANTS ONLY.

HTL Private Office Pty Ltd Complaints Policy

What to do if you have a dispute or complaint?

We hope you are delighted with our services, but if you have a complaint please let us know so we can work towards resolving it promptly and fairly.

You can make a complaint verbally or in writing by contacting your loan writer directly or by contacting HTL Private Office Pty Ltd as follows:

Email: Vasco.Duarte@htlprivateoffice.com.au

Phone: 0403 368 604

Mail: Level 3, 319 George St, Sydney NSW 2000

OR by using the following:

Email: resolutions@lmg.broker

Phone: 1800 275 564 (toll free) Monday to Friday 8am to 7pm (AEST)

Mail: Resolutions, Level 28 35 Collins Street Melbourne VIC 3000

When we receive a complaint, we will attempt to resolve it promptly. We will provide a written acknowledgement of receipt of the complaint within 24 hours (1 business day) or as soon as practicable unless the complaint is otherwise resolved in the meantime.

We will ensure that a final response is given to you as soon as possible, but within thirty (30) days of receipt of the complaint. For certain types of complaints, involving “default notices” or urgent disputes such as “applications for hardship”, a final response must be provided within twenty one (21) days.

If we are unable to deal with the complaint as it relates to a third party (for example, a lender), we may ask you to contact the relevant third party.

In cases where your complaint will take longer than 30 days to resolve, we will notify you in writing with the reasons for the delay and of your right to refer the complaint to the Australian Financial Complaints Authority (AFCA)

External Dispute Resolution Scheme

If we do not reach an agreement on your complaint, you may refer the complaint to an ASIC Approved External Dispute Resolution (EDR) Scheme. Our external dispute resolution provider is the Australian Financial Complaints Authority (AFCA).

You can contact AFCA using any of the following:

Online: www.afca.org.au

Email: info@afca.org.au

Telephone: 1800 931 678 (toll free)

Mail: GPO Box 3, Melbourne Vic 3001

External dispute resolution is a free service established to provide you with an independent mechanism to resolve specific complaints. You may refer the matter to AFCA at any time, but if our internal process is still in progress, they may request that our internal processes be completed before considering the matter further.

You can obtain further details about our dispute resolution procedures and obtain details of our privacy policy on request.

Enquire

Join Mailing List

Create Account

Sign In